Should I Exit Franklin India Smaller Companies Fund?

Investors in Franklin India Smaller Companies Fund are worried about its recent dip in performance. We evaluate its return and risk with respect to its benchmark to find out what investor should do

Investors in Franklin India Smaller Companies Fund are worried about its recent drop in performance. Is this because of the fund manager or because of the overall slump in smallcap stocks? We evaluate recent risk and reward of the fund with respect to its benchmark to find out what investors should do with the fund. Can new investors also consider this fund?

Regular readers may recall the review of this fund published in early 2019 where we pointed out its low volatility and performance. Let us now look at its recent performance. DIY investors can easily perform a similar analysis with any fund.

Before we begin, over 700 members have signed up for the video lecture series on Goal-Based Portfolio Management: Techniques to reduce fear, uncertainty, & doubt. This will discuss strategies to use and manage the right asset allocation no matter what the market condition is. Details about joining are available in this FAQ page.

As mentioned before, most of the investors in mutual funds in the last few years are new and have flocked to mid and smallcap mutual funds based only on their recent performance. Many are now disappointed that their funds are not able to replicate their past success. This is immature, to say the least.

Investors will need to consider the movement of the fund’s benchmark and how the fund has fared relatively before judging a fund. We saw how HDFC Mid-Cap Opportunities Fund has done quite well in spite of investor fears.

Let us now take a look at this Franklin Smallcap fund that started out as a closed-ended mid and smallcap fund. See fund review linked above for full history.

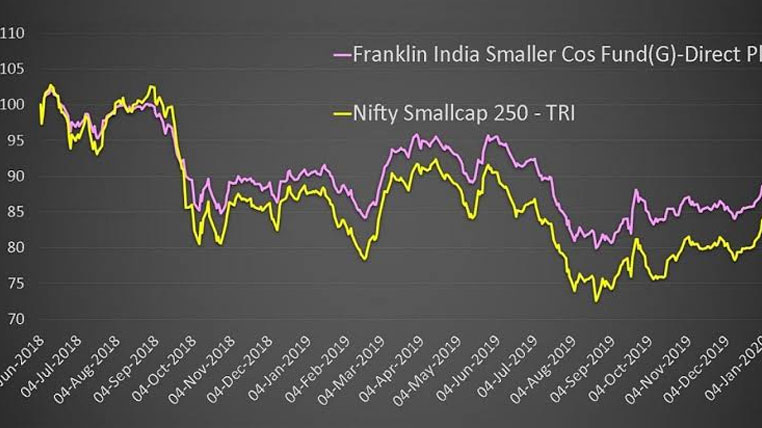

Franklin India Smaller Companies Fund vs Nifty Smallcap 250 – TRI

First, let us look at absolute returns for periods of less than a year. The fund has not done well in terms of downside protection. This is, while returns do not matter for such short periods, it is reasonable to expect an actively managed fund to fall less when the index is down.

| Month | Fund | Index |

| 1 | 4.54 | 7.20 |

| 2 | 3.15 | 5.59 |

| 3 | 5.47 | 11.71 |

| 4 | 7.62 | 11.32 |

| 5 | 7.00 | 11.28 |

| 6 | -1.67 | 1.28 |

| 7 | -6.31 | -4.46 |

| 8 | -1.92 | -1.10 |

| 9 | -6.36 | -6.40 |

| 10 | -3.21 | -3.17 |

| 11 | 1.78 | 3.98 |

However, if we look at annualized returns for longer durations, the fund has fared better. Although the fund has operated as a small cap fund only from 4th June 2018, it’s market cap history (see below) is fairly homogenous.

| Months | Fund | Index |

| 12 | -2.29 | -3.13 |

| 13 | 1.28 | 1.13 |

| 14 | -1.33 | -2.43 |

| 15 | 3.19 | 4.46 |

| 24 | -9.98 | -15.79 |

| 36 | 5.20 | 2.61 |

| 48 | 8.74 | 4.09 |

| 60 | 9.24 | 5.14 |

The fund has fared reasonably well since it started operations as a “pure” smallcap fund as seen in the featured image above.

The downside capture ratio is shown below for three different durations. A down capture ratio of 75% implies the fund has only captured 75% of the benchmark losses in the last three years whenever the benchmark fell down. These numbers are fairly impressive.

2017-Jan To 2020-Jan 75%

2018-Jan To 2020-Jan 68%

2019-Jan To 2020-Jan 66%

Should I Exit Franklin India Smaller Companies Fund?

Although the fund has had a poor run in the last year or so, its long-term performance is quite good. Investors should not dismiss this fund on the basis of the recent underperformance. Funds in this segment tend to be mercurial: large up and down movements. Comparatively, this is a sedate performer avoiding huge up or downswings.

New investors looking for smallcap exposure, but with a mature, long-term view can also consider this fund.

SOURCE freefincal.com